Using Pivot Points in Forex Trading

Using Pivot Points in Forex Trading

When examining Forex exchanging, you may have run over the expression "rotate focuses." This is an accumulation of help and opposition that is computed early to give you a thought with respect to where to purchase and offer a cash match. Rotate focuses aren't exclusively utilized in Forex, and indeed, have history in the fates pits in America. This harkens back to the times of open clamor exchanging, and pre-PC days.

Dissimilar to numerous different markers that you will run over, turn focuses are, by their extremely nature, prescient. Basically, what you are doing is seeing where the general turn in the market can be, and after that the following three help and the following three opposition levels. This marker is very intense, yet like numerous different pointers ought to be affirmed by either value activity or different factors, for example, a past help level.

The investigation of rotate focuses centers around the connections between the high, low, and shutting costs between each exchanging day. As it were, the past exchanging day's costs are utilized to compute the rotate point for the present day. The turn point itself, the focal point of the pointer, is viewed as "reasonable esteem" for the market going into the session. Keep in mind, if cost is rising and has pivoted, it is said to have kept running into opposition. On the other hand, if cost is falling and has pivoted, it is said to have met bolster. This marker will plot out what the "reasonable esteem" of the market is, and afterward three potential territories in the two headings called bolster one, bolster two, bolster three, and on the other hand opposition one, obstruction two, and opposition three to go about as rules.

|

| Using Pivot Points in Forex Trading |

The count

The count for the rotate purpose of the day is equivalent to the high of the past session added to the low of the past session and the end of the past session. Isolating these three numbers by three gives you the point. By knowing the rotate point, at that point you can extrapolate S1, S2, S3, R1, R2, and R3.

Rotate Point for current session = High (past session) + Low (past) + Close (past)

Whatever is left of the rotate focuses can be figured as following:

Opposition 1 = (2 x Pivot Point) – Low (past period)

Bolster 1 = (2 x Pivot Point) – High (past period)

Opposition 2 = (Pivot Point – Support 1) + Resistance 1

Bolster 2 = Pivot Point – (Resistance 1 – Support 1)

Opposition 3 = (Pivot Point – Support 2) + Resistance 2

Bolster 3 = Pivot Point – (Resistance 2 – Support 2)

Likelihood

One of the principle reasons that dealers utilize rotate focuses is that factually, they have worked out. For instance, the EUR/USD combine has printed a low for the day under S1 approximately 44 percent of the time. The high of the day has been above R1 approximately 42 percent of the time, while the low has been lower than S2 simply 17 percent of the time. Going ahead, R2 has been ruptured by the highs of the day just 17 percent of the time, while the lows and highs breaking above or underneath S3 and R3 just happens about 3 percent of the time. Along these lines, you can discover how likely cost is to go to one of these regions. Consider it like a chime bend, and the standard deviation conditions you learned in school. When you get past two standard deviations, it's extremely uncommon that you remain there, you can think about our three and S3 particularly like that.

Consider it along these lines; if the R1 level is just broken above around 42 percent of the time, at that point that implies that on the off chance that you are shy of the market, the chances are your ally in the event that you put the stop misfortune above obstruction one. Clearly, there's a whole mix and a plenty of conceivable outcomes here.

Fortunately, most exchanging stages currently incorporate turn focuses, so you won't really need to know how to do the counts.

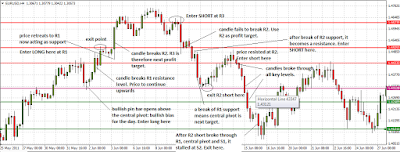

A precedent in real life

The connected outline of the AUD/USD combine on the hourly time period has the turn point pointer joined to it. Now, I would call attention to that not all MetaTrader stages accompany it, but rather there are free downloads accessible online in a large number of plans. In this specific set up, the rotate point from the earlier day is the yellow line, while the help levels are blue, and the opposition levels are red. As you take a gander at this diagram, see that the market began the day much lower than the rotate. The focal turn line, the yellow line, ought to be thought of as potential "reasonable esteem" for the market. Rather than beginning there, we began at S1, and began seeing help. You can see obviously that we at first moved towards the turn point, yet then broke higher. You will see that we slowed down at R1, where we shut the day.

You can see the significance of these levels on this outline, on the grounds that notwithstanding when they get broken the following level will begin to demonstrate its impact. What I have not called attention to on this diagram is that the focal rotate is at the 0.73 level, a territory that has been both help and opposition more than once. That is for what reason is anything but a tremendous shock to see that the market hammered into that level and did not get through it immediately. On the off chance that you had chosen to go long of the market dependent on S1, you likely would have taken benefit close to the rotate point. Past that, in the event that we break out to the upside as occurred, at that point you could look to the territory just beneath the turn point to put a stop misfortune. While not all by itself an exchanging framework, rotate focuses do deal with likelihood, something that a great deal of quantitative exchanging depends on. Remember that a ton of machines are exchanging monetary standards nowadays, so these proportions and recipes surely can become possibly the most important factor. So by utilizing turn focuses and Forex exchanging, you are including a touch of quantitative exchanging to your procedure.

Turn focuses are commonly utilized for shorter-term exchanging, yet there are rotate calls attention to there that are utilized for month to month time spans also. While ascertaining those, essentially supplant the high, low, close estimations of the past session with the earlier month. It works a similar route, in any time span.

No comments: